Frequently Asked Questions.

Here are the most common questions we’re asked about our service. If your question is not shown below, please email info@currencywave.com and we will be glad to help.

Why don’t I just use my bank to make a currency transfer?

Many businesses and individuals still use their bank to make international currency transfers but are unaware of the hidden charges built into the exchange rates quoted. Some banks charge up to 5% of the amount converted which is never disclosed to the customer. CurrencyWave can offer competitive exchange rates and zero bank charges.

What makes CurrencyWave different?

We believe that competitive currency exchange rates should be open to all and not just be the preserve of big multinational companies and the banks. Small/medium sized companies and individuals usually get a bad deal when it comes to currency conversions and our lower overheads mean we can pass big savings on to our customers. We use a market leading platform through our partners Currencycloud which is compliant with ISO27001 and offers transparency, real time exchange rates, payment tracking and superb customer service.

How does CurrencyWave make its money?

We charge a small fee which is incorporated into the real-time exchange rate we quote on our platform. This is displayed alongside the live interbank exchange rate so you can instantly see how our rates compare to the wholesale market. There are zero bank charges and zero account opening fees for the service.

Who can use the service?

Our service can be used by limited companies, LLPs, PLCs, sole traders, and individuals who have registered on our site. We are only able to onboard clients that are based in the permitted countries list.

Permitted Countries

In order to comply with anti-money laundering and sanction screening requirements, we can only onboard clients that are based in the following countries:

Austria (AUT)

Belgium (BEL)

Bulgaria (BGR)

Canada (CAN)

Croatia (HRV)

Cyprus (CYP)

Czech Republic (CZE)

Denmark (DNK)

Estonia (EST)

Finland (FIN)

France (FRA)

French Guiana (GUF)

Germany (DEU)

Gibraltar (GIB)

Greece (GRC)

Guadeloupe (GLP)

Hungary (HUN)

Iceland (ISL)

Ireland (IRL)

Italy (ITA)

Latvia (LVA)

Liechtenstein (LIE)

Lithuania (LTU)

Luxembourg (LUX)

Malta (MLT)

Martinique (MTQ)

Mayotte (MYT)

Monaco (MCO)

Netherlands (NLD)

Norway (NOR)

Poland (POL)

Portugal (PRT)

Réunion (REU)

Romania (ROU)

Saint Martin (French part) (MAF)

Slovakia (SVK)

Spain (ESP)

Sweden (SWE)

Switzerland (CHE)

United Kingdom (GBR)

United States (USA)

Please note the above countries are subject to change. Please refer to your relationship manager for real time updates on permitted countries.

What currencies do you cover?

Available currencies

Please visit the link below to see the currencies covered:-

https://support.currencycloud.com/hc/en-gb/articles/360018417079-Currencies

How does the platform work?

We have made the whole process of converting currency and making international payments as fast and reliable as possible with a simple 4-step procedure:

Step 1 – Once registered, you will be able to request a real-time quote online or, if you prefer, by calling our dealing desk direct.

Step 2 – Should you decide to accept the quote, we will confirm the amount of currency purchased and you will then need to send payment for the currency by bank transfer

Step 3 – Enter the beneficiary bank details which are automatically saved for any future payments

Step 4 – Send the currency payment to the beneficiary through our Payment Manager platform.

To see how the platform works in more detail, take a look at our demo video.

Can I receive a currency payment into my account?

If you are expecting to receive payment in a foreign currency (eg settlement of a foreign currency invoice you issued), then you can instruct the payer to send the funds direct to your own named CurrencyWave collection account. You can then either retain the funds in the account, convert them to another currency or use the funds to pay your suppliers. See ‘Receiving Payments’ below for further details.

Do you make a charge for sending the payment?

No, there are zero bank charges for sending a payment.

Can I pay/receive currency in cash or by cheque?

The platform is designed for business and personal international payments made electronically. We are not a travel money service and cannot pay out or receive funds in cash or by cheque.

Who are Currency Cloud / Equals Connect?

We use the services of two payment providers – Currency Cloud and Equals Connect

Currency Cloud are a leading FinTech business providing world class payment solutions to a wide range of institutions around the world including VISA, Travelex and Standard Bank. The Currency Cloud platform processes over £1bn of transactions per month through innovative and user friendly digital solutions. Authorised and regulated by the UK’s Financial Conduct Authority (FCA no. 900199), they are 100% owned by VISA Inc, one of the world’s largest financial institutions.

Equals Connect Limited are an FCA Authorised Payment Institution (FRN: 671508) and an HMRC registered Money Service Business. Established since 2007, they form part of the Equals Group plc, a company with shares listed on the Alternative Investment Market (AIM).

Where can I see your Terms & Conditions?

Can I use the CurrencyWave platform for any purpose?

As part of the ongoing commitment to mitigate the risk of money laundering and terrorist financing, our payment provider has a number of restrictions on the type of industries, activities, and countries we can support and service. Failure to comply with these restrictions can result in delayed payments or rejected payments with continuous breaches leading to account closure.

Non-permitted industries – global

- Weapons / military-grade security

- Multi-level marketing

- Pawnbrokers [MCC: 5933 – Pawn Shops]

- Political organizations [MCC: 8651 – Organizations, Political]

- Precious metals and stones [MCC: 5094 – Precious Stones and Metals, Watches and Jewelry]

- Adult entertainment

- Drug paraphernalia

- CBD and related products

- Carbon credits

- Cryptoassets

- Gambling [MCC: 7995 – Betting (including Lottery Tickets, Casino Gaming Chips, Off – track Betting and Wagers)]

- Ponzi / pyramid schemes

- Firms involved in the servicing of illegal goods/services including but not limited to: counterfeit goods/trademark infringement, human trafficking, child labor, prostitution.

- Mining and extraction

- Speculative trading

Non-permitted industries – United States of America

- Chemicals

- FDA classified medical devices

- Medications or prescription drugs

- Alcohol [MCC: 5813 – Drinking Places (Alcoholic Beverages), Bars, Taverns, Cocktail lounges, Nightclubs and Discotheques]

- Tobacco [MCC: 5993 – Cigar Stores and Stands]

- Dietary supplements

- Seeds or plants [MCC: 5193 – Florists Supplies, Nursery Stock, and Flowers]

- Regulated financial services

- Outbound telemarketing [MCC: 5966 – Direct Marketing-Outbound Telemarketing Merchants]

Non-permitted client types

- Financial Institutions making payments on behalf of other financial institutions, also known as ‘nested relationships’ or ‘layering.’

- Shell banks

- Unregistered charities

Non-permitted activities

- Clients are not allowed to use our services to speculate changes in FX

- Transactions deriving from crypto currencies

How do I open an account and how long does it take?

First, you need to register for an account on our website. Registration only takes a few minutes to complete and we will email you as soon as your account has been set up. Accounts can normally be established the same day providing we can successfully complete all the necessary identification and address checks electronically.

Will I have to send you any documents to open an account?

Strict anti-money laundering and terrorist financing regulations mean that we must undertake thorough identity and address checks on all our customers to ensure that we know who we are dealing with. Most of these checks can usually be done through electronic means but if this is not possible then we may need to request further supporting documentation from you.

How much does it cost to open an account?

There are no account opening fees.

Do I need to pre-fund my account?

No, you do not need to pre-fund your account prior to executing a currency conversion. After the conversion has been executed, we will then confirm when payment for the transaction is due.

I didn’t receive a text message with instructions to download the app

Sometimes poor signal can result in SMS messages being delayed. Please check your reception and try again. On the confirmation screen, you can also check the mobile phone number you entered, just to make 100% sure it is correct. If the number’s correct and your signal is fine, you can always search for the app by typing “Authy” in the App Store (Apple) or Play Store (Android).

I don’t have an Apple or Android device for the Authy app

Users can download a Desktop app on a Windows or Apple computer by visiting: https://authy.com/download/.

Can I use another authenticator app like Google Authenticator instead?

Not at this time, we believe Authy is the best app for the job. But this is something we’ll be monitoring demand for with a view to introducing in future.

I’m having problems setting up the Authy application

If you are experiencing difficulties downloading the Authy app to access the Currency Cloud Direct platform, visit the Authy Help Centre for further assistance.

How often will I be asked to verify my identity

Currency Cloud Direct Platform

Every time you login from a device you haven’t used before, you will be asked to verify yourself using the Authy app. If you have ticked the “Remember this device for 15 days” option on the 2-step login page, we won’t ask you to verify on subsequent attempts over the next 15 days. After this time has lapsed, you will need to verify yourself using the 2-step login again.

Equals Connect Platform

Every time you log in you will be prompted to enter a One Time Password (OTP) which will be sent to your mobile device by SMS message.

I don’t have my phone with me

You need to have access to a mobile device registered to receive your 2-factor authentication prompts in order to keep your account secure. If you can’t access your mobile device and urgently need to access your account, please contact support at info@currencywave.com.

I’ve lost my phone or have a new phone number

If you have lost your phone or need to register a new phone number then please contact info@currencywave.com for assistance.

What is Two-Factor Authentication?

Two-factor authentication (or 2FA) is an extra layer of security to make sure someone trying to access their online account is who they say they are. In addition to providing information you know such as username and passwords (1st factor), you’ll also be asked to use something you have such as a smartphone (2nd factor) to confirm your identity.

We use a market leading platform through our partners Currencycloud which is compliant with ISO27001. Two-factor authentication is via the Authy app which you should download to your smartphone.

The Equals Connect platform sends 2FA verification via SMS text message.

How much can I transfer through the platform?

There is a minimum currency conversion size of £1,000 and no maximum. Payments can be sent in any amount.

When is my currency transaction executed?

When you request a real-time exchange rate from the platform, you will be given 20 seconds to decide whether or not you wish to accept the quote. If you choose to accept the quote before the 20 seconds is up, your currency transaction will be executed immediately at the exchange rate given. If you decide not to accept the quote, the exchange rate will expire and you cannot proceed with a currency conversion unless you re-request another quote.

What exchange rate will I get?

The exchange rate quoted on the platform is derived from the live interbank wholesale rate and will include our cost for conversion. This quote is displayed alongside the live interbank exchange rate so you can instantly see how our rates compare to the wholesale market.

Can I fix an exchange rate for a future payment?

Yes, you can defer payment for the currency by up to 12 months by selecting your preferred Date of Conversion prior to requesting a quote. This is known as a Forward Currency Contract and allows you to lock in an exchange rate today for delivery at some time in the future. Forward currency contracts are a useful tool and can be used to hedge against the risk of future currency movements.

Do I have to place a deposit for a forward currency transaction?

Yes, you will usually need to send a deposit of 5% of the contract value in order to secure the exchange rate until the balance becomes payable on the settlement date you have selected. This will be confirmed to you on the platform and by email.

This is known as initial margin and you will be contractually obliged to maintain this level of margin over the period of the forward contract. Should the market exchange rate subsequently move against you, then you will be asked to top up the margin in order to keep your position open.

For example:-

You sell £100,000 and buy EUR at a forward exchange rate of 1.15 for settlement in 6 month’s time. The initial deposit on this transaction will be £100,000 x 5% = £5,000.

If the exchange rate subesquently rises to 1.18, there will be an unrealised market loss on your contract of 2.6% which reduces your available margin deposit down to £2,400. In order to keep your position open, you will need to top up your margin by sending a further £2,600. Failure to do so could result in your position being closed and you will be responsible for any market losses.

Assuming no additional margin calls are required, at the end of the contract you will need to send in £92,400 to settle the balance and take delivery of the EUR.

What is a Spot exchange rate?

Generally, the price of a currency pair (e.g. GBP/EUR) is commonly quoted as a ‘spot’ exchange rate where payment for the currency being purchased is due straight away.

What is a Forward exchange rate?

A forward exchange rate is quoted on the conversion of a specific amount of currency where settlement is not due until sometime in the future (up to 1 year usually). The forward exchange rate may include a premium or discount from the spot exchange rate which is based on the interest rate differential between the countries of the two currencies, calculated over the length of the contract. If the country of the currency being purchased has higher interest rates than the currency being sold then the forward price will contain a premium over the spot price and vice versa.

What is a Limit order?

If you have a target exchange rate in mind you can instruct us to execute your currency transaction automatically when this target is reached. We will monitor the exchange rate on your behalf leaving you to concentrate on running your business.

What is a Stop Loss order?

As the name suggests, a stop loss order is designed to prevent further losses should the exchange rate deteriorate beyond a specified level. If the exchange rate worsens to your pre-determined target, we will automatically execute the currency transaction on your behalf.

When will I need to send payment to settle the currency transaction?

You will need to send payment for your currency transaction by bank transfer so that cleared funds arrive no later than the selected settlement date/time. We will send you a trade confirmation email which shows all the transaction details, including the settlement date and time.

Where do I send payment for my currency transaction?

Payment should be sent by bank transfer using the bank account information detailed in our trade confirmation email. It is important that you include the Payment Reference information stated in our email so that your funds can be applied without delay to the correct transaction. We advise that you send funds via a same day priority payment.

When will the currency payment be sent to my beneficiary?

Providing cleared funds are received from you on the due settlement date, onward payment of the currency to your beneficiary will be sent the same day. Receipt of the currency into the beneficiary’s bank account will depend on the time of day your funds are received and the currency being sent but for most currencies we provide same day payments.

Can I make payment by card, cash or cheque?

No, you must make payment via a same day priority bank transfer.

What should I do if I make a mistake when transacting?

If you have made a mistake, please contact us on +44 (0) 113 451 0180 as soon as possible.

What information do I need to set up a payment beneficiary?

You will need both the IBAN (International Bank Account Number) and bank BIC/SWIFT code details for the bank account you wish to send the payment to. It is advisable to ask the recipient to check these details with their bank first before setting up the payment. You will also need the full name and address of the payment beneficiary.

What is an IBAN?

IBAN stands for International Bank Account Number and is an internationally recognised alphanumeric format for bank account numbers. The IBAN incorporates the domestic bank account number as well as a country code, bank identifier and other validation information.

What is a BIC/SWIFT code?

BIC stands for Bank Identifier Code and is sometimes referred to as the SWIFT address. The BIC is a universally recognised system for identifying the financial institution to where funds are being sent.

Are beneficiary bank details saved on the platform?

Yes, beneficiary bank details are saved in the Beneficiary Manager area of the platform so you do not need to keep entering this information every time you wish to send a payment.

Can I pay businesses and individuals?

Yes, payments can be sent to both businesses and private individuals.

Can I set up several beneficiaries to send payments from one currency trade?

Yes, through Payment Manager you can allocate funds from a currency conversion and send payment to as many beneficiaries as you wish.

How will I know if payment has been sent to the beneficiary?

Once payment has been released, we will send you a payment confirmation email and the status of the transfer will be updated to ‘Completed’ in the payment history on the platform.

How are payments sent?

Payments sent by Priority (SWIFT) is the fastest and most secure method of making an international payment. Payments to some destinations, such as the UK, USA, EU and Canada have the option to send via domestic payment methods (Regular).

How long does a transfer take?

Depending on the country and time of day sent, for most currencies we provide same day payments. In some instances this may take longer depending on the recipient bank and whether they use a 3rd party correspondent bank to route their payments. Please note that public holidays will delay payments if they fall within the payment time cycle.

Is there a fee for sending a payment?

No, there are no payment fees.

Why has the recipient received less money than I sent?

Some recipient banks make a charge for processing an international receipt, or they use the services of a correspondent bank or banks to route the payment to them. This can result in charges being levied which they deduct from your payment before crediting the account.

What is a SWIFT payment?

SWIFT is an acronym for Society for Worldwide Interbank Financial Telecommunications and is the largest secure global messaging system used by financial institutions around the world to send and receive information about the transfer of funds between each other. SWIFT is the global standard for sending payments overseas quickly, accurately and securely.

What is an MT103 (SWIFT)?

An MT103 is an international standard message format that banks and financial institutions use in the SWIFT network in order to instruct a transfer of funds from one customer to another customer. An MT103 contains a record of all the standardised information required for a cross border payment, (otherwise known as a ‘telegraphic transfer’ or ‘wire transfer’) and can be used as proof of payment.

How can I receive payments?

Clients are issued with a single IBAN own named account which allows them to receive SWIFT payments in 34 currencies from over 50 permitted jurisdictions.

In addition, you can receive USD payments from payers based in the USA and EUR payments from payers based in the EU through the Local Collections Account facility. Payers based in those jurisdictions can make a domestic payment to your account without having to incur the costs of making a cross-border payment.

What are SWIFT Collections?

SWIFT collections provide you with the ability to receive third-party funds from your customers in all unrestricted currencies. Then, when you’re ready, you can convert these funds back to your base currency, at competitive rates, on your own terms. This is a simple and cost-effective way of collecting money globally.

What currencies can I collect funds in?

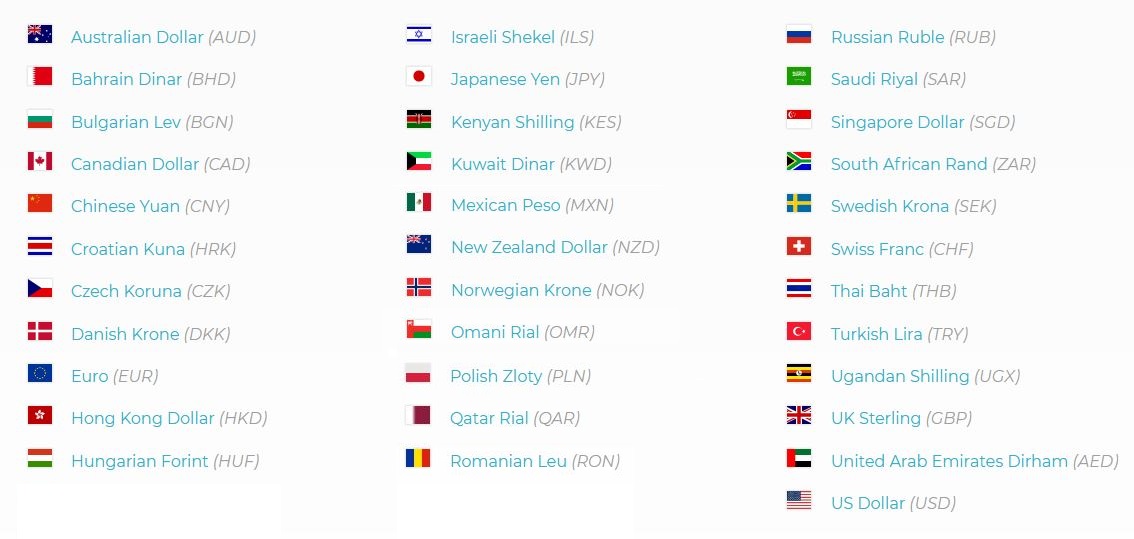

You can collect funds from third parties in the currencies* shown below:

*For clients based in the EU, we are unable to receive the following currencies: BHD, BGN, CNY, ILS, KWD, OMR, QAR, RUB, THB, UGX. If funds are received in these currencies for EU clients, they will be rejected and returned.

Which countries can I receive funds from?

Funds must arrive from one of our payment provider’s permitted jurisdictions. Permitted jurisdictions apply to where funds are originating from and/or where a payer is geographically based. If either you or your payers send funds from a bank account outside the permitted jurisdictions, or they are geographically located outside of the permitted jurisdictions, the funds will be rejected.

You can see the full list of permitted jurisdictions on our payment provider’s website here.

What details do I give out to my customers?

Simply log in, select ‘Balances’ from the left-hand navigation and select currency. Then click the ‘Add CURRENCY’ button in the top right hand corner of the screen. This will show you the account name, number and SWIFT BIC along with a reference you can give out to your customers.

Does my customer need to reference the payment?

Yes. It is essential that your customers reference your client account at CurrencyWave when sending you a payment otherwise delays will occur. Your client reference number can be found under the bank details of the currency wallet, at the top left-hand corner of the log in screen and is also quoted on your email trade confirmations.

How do I get my funds?

Once you have provided your customer with the account details and they have made their payment, the funds will arrive on the platform. The funds will be reconciled to the referenced account and then updated on your balance and confirmed by email.

How long will it take for my funds to arrive?

Funds will be subject to the cut-offs and timelines of the sending bank used by your customer and the clearing system for the given currency. Once the funds have arrived, and provided they are referenced by your customer correctly, they will be credited to your account within an hour.

What information can I see about the sender?

We provide you with as much information as is passed from the sending bank when it comes to who has sent you the funds. This information can vary depending on the bank sending the funds. The main fields available are ‘reference’ and ‘name’. Some banks will also provide the address details.

Sender details are available within the CurrencyWave platform by viewing your transactions and then selecting the reference on the funding transaction.

Why didn’t the full amount sent by my customer arrive?

Sending funds via the SWIFT network can be subject to correspondent banking fees. These fees occur when the sending bank and the beneficiary bank do not have a direct relationship, so an intermediary bank is required to forward the payment. Any fees taken by intermediary (or correspondent) banks are outside the control of CurrencyWave.

Can my customer send the funds in full, without correspondent bank fees?

Yes! CurrencyWave currently offers named local collection accounts for EUR and USD receipts which are not subject to these correspondent bank fees. We’re continuously adding more currencies to this list so if you’re interested in hearing more about our Local Collections capability, please speak directly to your Account Manager for more details.

How secure are you?

We use a market leading platform through our partners Currencycloud which is compliant with ISO27001. As a holder of an E-Money licence they are subject to stringent oversight and control checks by the FCA to allow client funds to be held. Funds are safeguarded by our FCA-regulated e-money partners at a credit institution. In the unlikely event of Currencycloud ceasing to exist, your money remains protected as it is ring fenced from the assets of the firm and cannot be accessed by creditors.

Our payment services provider Currencycloud has been acquired by Visa Inc, one of the largest financial institutions in the world.

What if I have forgotten my password?

Click on the “Forgot Password” link on the login page and we will allow you to reset your login credentials via an automated email service.

Who should I contact with a support query?

Please email info@currencywave.com, or call +44 (0) 113 451 0180