Clients who apply for a multi-currency account can receive third-party payments from payers based in all unrestricted countries supported by our payment platform provider, Currencycloud.

How does it work?

The multi-currency account provides you with the ability to receive international payments in 34 different currencies through a single IBAN account. This can be used for receiving foreign currency payments such as customer invoices or revenue from your overseas subsidiaries. You can hold currency on the account or convert these funds back to your base currency at competitive rates and on your own terms. This is a simple and cost-effective way of collecting money globally.

Where can I receive funds from?

Funds must arrive from one of our payment provider’s permitted jurisdictions. Permitted jurisdictions apply to where funds are originating from and/or where a payer is geographically based. If either you or your payers send funds from a bank account outside the permitted jurisdictions, or they are geographically located outside of the permitted jurisdictions, the funds will be rejected.

You can see the full list of permitted jurisdictions on our payment provider’s website here.

What details do I give out to my customers?

Simply log in, select ‘Balances’ from the left-hand navigation and select/add a currency. Then click ‘Add’ for the currency you wish to receive. This will show you the account name, IBAN and SWIFT/BIC you can include on your invoices.

Which currencies can I receive into my account?

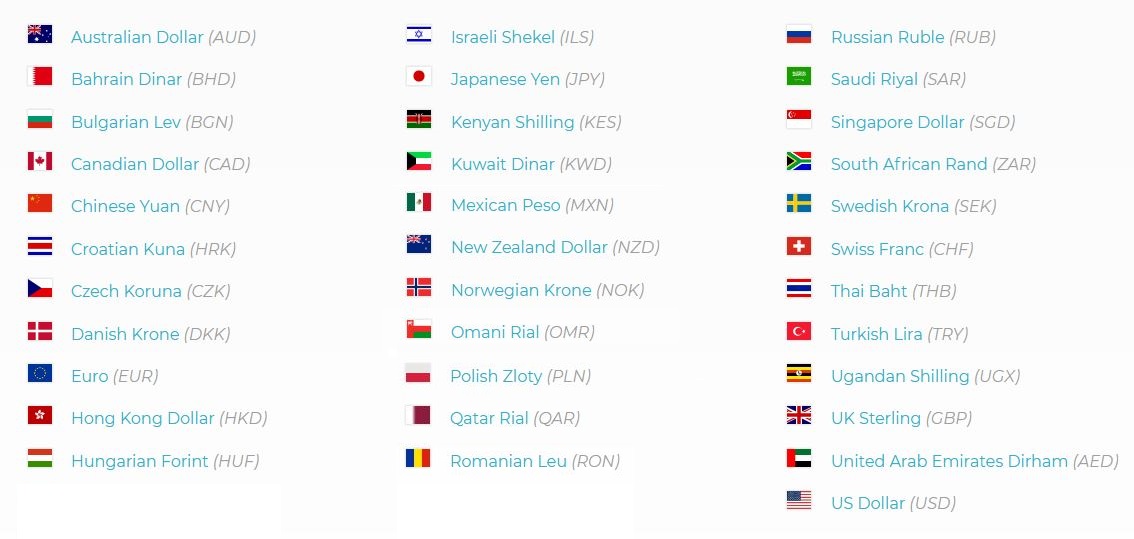

The account can receive payments in 30+ currencies*:

*For clients based in the EU, we are unable to receive the following currencies: BHD, BGN, CNY, ILS, KWD, OMR, QAR, RUB, THB, UGX. If funds are received in these currencies for EU clients, they will be rejected and returned.

How long will it take for my funds to arrive?

Funds will be subject to the cut-offs and timelines of the sending bank used by your customer and the clearing system for the given currency. Once the funds have arrived, they will be credited to your account within an hour and confirmed to you by email.

What information can I see about the sender?

We provide you with as much information as is passed from the sending bank when it comes to who has sent you the funds. This information can vary depending on the bank sending the funds. The main fields available are ‘reference’ and ‘name’. Some banks will also provide the address details.

Sender details are available within the platform by viewing your transactions and then selecting the reference on the funding transaction.

Why didn’t the full amount sent by my customer arrive?

Sending funds via the SWIFT network can be subject to correspondent banking fees. These fees occur when the sending bank and the beneficiary bank do not have a direct relationship, so an intermediary bank is required to forward the payment. Any fees taken by intermediary (or correspondent) banks are outside the control of CurrencyWave or Currencycloud.

Can my customer send the funds in full, without correspondent bank fees?

Yes! The platform currently offers local collection accounts for GBP, EUR and USD receipts which are not subject to these correspondent bank fees. We will be adding more currencies to this list so if you’re interested in hearing more about the Local Collections capability, please speak directly to your Account Manager for more details.

More Insights